The UK events industry is a significant economic contributor, with an estimated annual value of £61.6 billion. This can be divided into two groups: business events and public events.

Business events, such as conferences, trade shows, meetings, and product launches, are essential for growing businesses and nurturing relationships. They support thousands of jobs and drive revenues for hotels, venues, restaurants, and a multitude of SMEs that form the industry’s supply chain.

Public events, such as music festivals, sporting events, and cultural festivals, attract large, paying audiences that positively impact local economies. They are essential to both culture and society, supporting thousands of jobs across the UK and benefiting a variety of suppliers.

The role and impact of events by type

Business events combined provide around £33.6 billion to the UK economy. Exhibitions, conferences, meetings, and people travelling to the UK to attend events contribute the lion’s share.

Exhibitions

UK exhibition organisers are a British success story that doesn’t receive the attention it deserves. An annual report by Jochen Witt Consulting (JWC) analyses the performance of the top 20 exhibition companies worldwide. The top three (Informa, RX, and Clarion) are all homegrown and, in 2023, generated more revenue than the remaining 17 global companies combined.

In 2024, there were an estimated 1,145 exhibitions held at the UK’s main venues, according to the Size and Scale Index for Exhibitions. They attracted 7.2 million visitors and contributed £10.9 billion to the UK economy.

These events support around 114,000 jobs, both directly and indirectly. The leisure sector represented just under a fifth of all exhibitions held in 2024, with healthcare and the pharmaceutical sector accounting for 13% of all shows.

Conferences, meetings, and business travel

After trade shows, the remaining business event types (meetings, conferences, product launches) contribute around £16.3 billion to the UK economy.

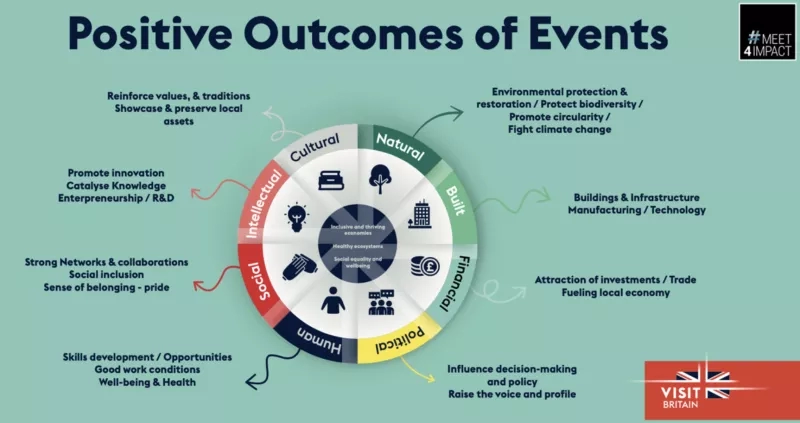

Conferences and meetings drive innovation and act as platforms for knowledge-sharing, research and development, entrepreneurship and other positive outcomes shown here:

According to Visit Britain’s International Passenger Survey, around 6.5 million business visitors visit the UK each year with 1.5 million business event visitors attending meetings and conferences. These business visitors are thought to spend around £5.2 billion and bring with them their expertise and opportunities for investment and job creation.

The average spend of a visiting delegate is 38% higher than an average visitor (£1,131 versus £819) and their spend per night is more than double (£244 per night versus £106).

With a five-night average stay, business event travellers are more valuable to the economy than leisure tourists because they book more expensive hotels and eat in more expensive restaurants. They are also more likely to extend their stay beyond the conference, adding on a family weekend break for example.

Outdoor events (live music, sporting, cultural)

The combined value of outdoor events to the UK economy is around £28 billion.

Sporting events contribute £9.75 billion, live music generates £6.6 billion, arts and cultural events add £5.6 billion, and agricultural fairs and shows contribute another £6 billion. The remaining £100 million is generated by Air Shows, such as the one at Farnborough each July.

In a report published in 2023, UK Sport assessed the impact of staging 12 events in 25 British cities which had received funding via The National Lottery, the Exchequer or the UK Government directly.

The report found that hosting major sporting events promoted the reputation of the UK around the world, provided a platform to showcase and promote British cities and regions to a global audience, and also created a strong sense of pride in the UK as a world-leading host nation for major sporting events.

The 12 events themselves attracted 2.7 million people, delivered a direct economic impact of £132 million and supported 1,600 jobs.

According to LIVE, the voice of the UK’s live music industry, concerts support jobs for nearly 230,000 people. That’s 20,000 more people than the entire attendance of the Glastonbury Festival and an increase of 9.4% since 2019.

In 2023, London accounted for nearly a third (30.6%) of total live music revenue. Manchester took the second highest at 7.4%, and Glasgow took the lead in Scotland with 5.5% of the UK’s share. Other cities in the top 10 included Edinburgh, Birmingham, Cardiff, and Belfast.

The role and impact of event associations

The broad and fragmented nature of the UK events industry means that there are a wide variety of associations representing the companies and interests of each specialist area.

Below are three key industry bodies helping to lobby the Government on the benefits of business events (including exhibitions). However, there are many more associations representing everything from Association Event Planners (ABPCO) and meetings industry standards (mia) to outdoor event suppliers (NOEA) and independent festival organisers (AIF).

The Events Industry Alliance (EIA)

The EIA is the umbrella group for the Association of Event Organisers (AEO), the Association of Event Venues (AEV) and the Event Supplier and Services Association (ESSA).

It works to ensure that the interests of exhibitions and business events in the UK are represented, understood and communicated to the Government across three pillars - Growth, Becoming the World’s Meeting Place, and Developing Skills and People.

The EIA’s work includes the annual Economic Impact report carried out in association with Oxford Economics.

The Business of Events (TBOE)

The Business of Events is a Think Tank and Advocacy Network working to raise the importance and profile of business events as facilitators for economic, community and social development.

It has strong connections with the Department for Culture, Media and Sport and lobbies the Government on the seven policies outlined later in this article and detailed in its UK Policy Agenda.

TBOE stages an annual Global Policy Forum, attended by MPs and senior industry leaders, and publishes regular research and insights.

It is run by the communications agency Davies Tanner, which also manages the All-Party Parliamentary Group for Events - a cross-party group of MPs representing the UK events industry in Parliament.

UKEVENTS

UKEVENTS (formerly the Business Visits and Events Partnership BVEP) is a collective voice for a wide range of industry trade associations and convention bureaux, including London & Partners, VisitBritain, Tourism Northern Ireland, Visit Scotland Business Events, and Visit Wales.

It supports cross-industry lobbying campaigns and creates working groups dedicated to specific member issues and opportunities, such as the role business events can play in supporting the UK’s journey to net zero.

How the UK Government can help the UK events industry

The EIA’s key asks of the Government

- Develop an international trade strategy that recognises, leverages and supports the UK Business Events sector to drive growth for a global Britain.

- Create a strategic unit for events across the Government. The unit should have a dedicated representative from each department.

- Attract, grow and incentivise business events to facilitate sustainable economic growth across the nations and regions within the UK.

- Make events a key growth area of focus. This would encourage inbound investment and outbound trade through up-weighted grants and other measures.

- Tax reliefs in recognition of the economic benefit and attraction to foreign tourism that the industry facilitates, similar to those the film and TV sector have received in the past.

- Establish SIC and SOC codes to enable analysis of the industry’s dynamic workforce and substantial economic impact.

- Deliver on building the infrastructure necessary to ensure our venues stay world-class.

- Encourage industry innovation through seed funding and tax breaks to incentivise the growth of existing events and attract new events.

- Funding for event training and apprenticeship schemes, with Ministers talking up the sector’s career potential at every opportunity.

TBOE’s key asks of the Government

- Update SIC codes to ensure accurate representation and targeted support.

- Easier visa schemes to facilitate international collaboration post-Brexit for both inbound and outbound events.

- An event tax credit scheme to attract new events and support existing ones through financial incentives.

- Attract more international events and provide more support to position the UK as a top destination for global events.

- Provide support to drive the UK’s competitiveness by using events as a catalyst for growth across different sectors.

- Invest in the country’s convention bureaux, empowering them to drive economic development.

- Leverage events for policy objectives by using them to deliver and promote government policies.

UKEVENTS’ key asks of the Government

- The delivery of a nationwide Events strategy to bring all the resources of Government together across several Whitehall departments on a par with UKSport and the Arts Council.

- Introduce tax allowances on a par with those available in TV and film production.

- Align major events already held and those that the UK might bid to win in the future with government-priority industrial sectors.

- A reduction in VAT, reform of business rates and increased local authority funding for events.

- Easier access for overseas visitors attending events, whether by reform of the visa system or introduction of business visit exemptions.

- Additional funding for VisitBritain's Business Events Growth programme.

What does the future hold for the UK events industry?

After years of lobbying and setbacks, including convention bureau funding cuts and several increases in the costs and complexities of visas to attend events in the UK, at the start of 2025, Dame Caroline Dinenage MP, Chair of the Culture, Media and Sport Select Committee, invited proposals for a series of planned inquiries into different industries.

The DCMS received 256 submissions from a broad range of industries. The EIA, TBOE, and the ACC Liverpooleach submitted a proposal on behalf of the business events industry.

The events industry proposals were accepted and the UK’s business events sector has been chosen as one of five proposed Select Committee ‘State of Play’ investigations.

An influential group of cross-party MPs will examine the business events sector and propose recommendations to the Government as part of this specialised Department of Culture Media and Sport (DCMS) Select Committee inquiry.

The much-heralded inquiry is planned for late 2025, and the events and exhibitions industry will be invited to give evidence.

“My Committee are keen to understand the challenges, growth potential and how to avoid falling behind international competitors. If we don’t jump at the opportunity to grow this sector, we may lose out on its many benefits. The success of the business events sector is vital to the continuing success of all the CMS sectors and as the Select Committee, we are not going to take our eye off the ball. We want to amplify the voices that say future growth isn’t guaranteed unless we get our act together and push the Government to take the action needed to support the growth of this thriving industry.”

Dame Caroline Dinenage MP, Chair of the Culture, Media and Sport Select Committee

It has taken a long time to reach a point where the UK business events sector will finally come under the microscope from its designated government department, the DCMS.

The UK Government has an ambitious plan to attract 50 million international visitors per year to Britain by 2030 and the whole events industry will need to play its part.

Depending on the evidence heard by the DCMS inquiry and the recommendations made to Parliament, an industry that generates £61.6 billion for the British economy could finally start to see the support and help it deserves.